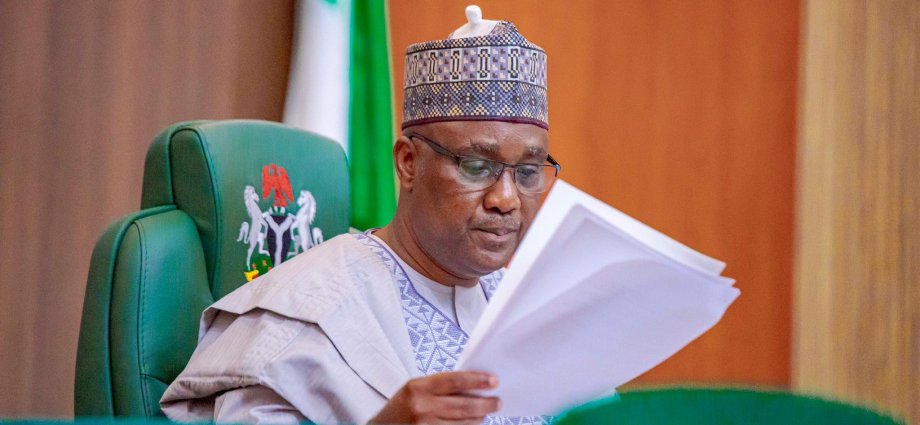

N98 Billion Probe: House Speaker Abbas Moves to Dismiss Insurance CEOs’ Restraining Lawsuit

The Speaker of Nigeria’s House of Representatives, Rt. Hon. Abbas Tajudeen, has filed a formal request asking the Federal High Court in Abuja to throw out a lawsuit brought by the Nigerian Insurers Association and 17 insurance companies. The legal action aims to block legislators from investigating alleged N98.4 billion liabilities involving non-government-funded insurance providers.

Legal Standoff Intensifies

In a counter-affidavit dated November 6, 2025, obtained exclusively by Nairametrics, Speaker Abbas and other lawmakers have mounted a robust defense against what they characterize as an attempt to obstruct legitimate parliamentary oversight. The document was filed by Mrs. Bukola O. Adeagbo, lead counsel representing Tajudeen, the House Committee on Capital Markets and Institutions, and committee members Hon. Kwamoti B. Laori and Hon. Bob Solomon.

This legal maneuver comes against the backdrop of an existing temporary restraining order that currently prevents the House from summoning the NIA and the 17 insurers until the substantive case is fully heard.

Constitutional Powers at Stake

The lawmakers’ affidavit presents a compelling constitutional argument, asserting that insurance executives operate under legislation passed by the National Assembly and are registered with government agencies that receive funding based on those same laws.

“The Defendants have the power to investigate allegations, procure evidence, and summon any person, including the Plaintiffs, for the purpose of any investigation into matters under their legislative competence,” the court document states unequivocally.

The filing, submitted by a House Committee on Capital Markets official, further emphasizes that federal legislators derive their authority from Sections 88 and 89 of the 1999 Constitution, which empower them to invite individuals and examine how enacted legislation is being implemented in practice.

Transparency or Obstruction?

The legal counsel for the lawmakers suggested that the insurers’ refusal to cooperate with the investigation raises legitimate questions about what they might be concealing. The invitation to the insurance companies was framed as part of the House’s constitutional duty to expose alleged corruption and financial waste.

Characterizing the insurers’ lawsuit as “frivolous,” the lawmakers have urged the court to dismiss the case in the interest of justice, noting the companies’ continued refusal to honor the House’s invitation. The case has been adjourned to December 9, 2025, setting the stage for a crucial legal showdown.

Background to the Dispute

Earlier developments saw Justice Emeka Nwite grant a restraining order in favor of the insurers, acknowledging that their CEOs “stand the risk of being arrested” while the main case remains pending.

Professor Taiwo Osipitan, SAN, leading the legal team for the insurers, has argued that his clients are privately funded entities regulated by executive agencies including the National Insurance Commission (NAICOM), the Corporate Affairs Commission (CAC), and the Federal Inland Revenue Service (FIRS)—not the House of Representatives.

The plaintiffs have asked the court to prevent lawmakers from enforcing directives in their July 3, 2025 invitation letter or any subsequent summons to the CEOs until the main suit is resolved.

In earlier public statements, the NIA had accused the House Committee on Capital Markets and Institutions of “legislative overreach” in its investigation of certain member companies for alleged multibillion-naira financial violations. The Association, which represents licensed insurance and reinsurance firms across Nigeria, expressed serious concerns about the Committee’s public statements regarding alleged financial misconduct by some members.

This legal confrontation emerges from the House’s investigation into 25 insurers over allegations of failing to remit multibillion-naira revenues owed to the Federal Government of Nigeria, raising fundamental questions about parliamentary oversight and corporate accountability.

Source: Nairametrics