The Global Entrepreneurship Monitor (GEM) 2024/2025 Women’s Entrepreneurship Report delivers a powerful, data-driven snapshot of the persistent gender gap in entrepreneurship. While women are starting businesses at impressive rates, the systemic barriers they face are not just about entry, but about sustainability, scale, and equity. This analysis moves beyond summarizing the findings to provide a strategic framework for understanding and dismantling these barriers, transforming data into actionable insight.

Reasons for closing a business

The stark statistic that women are 47% more likely than men to close a business for family or personal reasons (21.0% vs. 14.3%) is not merely a data point—it is a symptom of a deeper, structural inequity. This “ongoing tension” highlights the disproportionate burden of unpaid care work and societal expectations that still fall primarily on women. For many male entrepreneurs, business closure often leads to “another opportunity,” framing entrepreneurship as one career path among many. For women, however, closure is frequently framed as a personal failing or necessity, rather than a strategic pivot, underscoring how entrepreneurship is often a more constrained choice.

The GEM report, drawing on insights from over 160,000 adults globally, reveals a nuanced landscape. While the overall business closure rates are similar (3.4% women vs. 3.8% men), the reasons behind those closures tell the true story. The top reasons—profitability and access to finance—are shared challenges, but the critical divergence in “family/personal reasons” points to a unique ecosystem failure for women.

Several options vs the only option

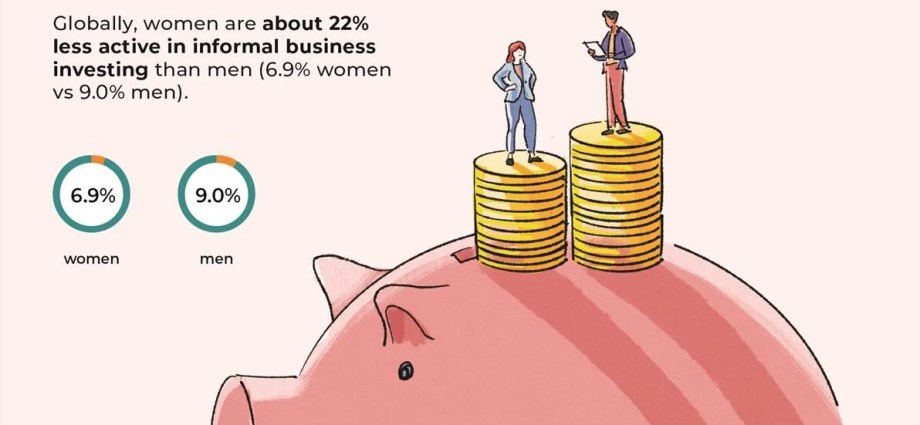

Perhaps one of the most revealing findings is in the realm of investment. The data shows a self-perpetuating cycle: women were 2.5 times more likely to invest in women, yet two-thirds of all informal investment still flows to men. This creates a dual representation problem: women are severely underrepresented as both capital allocators and capital recipients. This isn’t just a pipeline issue; it’s a network and bias issue. Homophily (the tendency to associate with similar others) in investment networks means that male-dominated investor circles perpetuate funding for male-led ventures, while women investors, though more likely to fund women, control a far smaller portion of the overall capital pool.

Investment

Other critical findings from the report paint a picture of both progress and persistent gaps:

- Innovation Parity: In 18 of 51 countries, women are at parity or higher in launching innovative startups, proving that the capability for market disruption is evenly distributed when barriers are lowered.

- Sectoral Segregation: Women are less than half as likely as men to be in the ICT sector and 11% less likely to see AI’s benefits, risking exclusion from the highest-growth, highest-value industries of the future.

- Regional Progress: Notable surges in startup rates in countries like Jordan and Morocco demonstrate that targeted ecosystem support can yield dramatic results.

Other findings

The report’s six recommendations provide a foundational roadmap. To add unique value and practical depth, we must expand on their strategic implementation:

- Tailor Support for Diverse Contexts: This goes beyond translation. It means designing programs that account for local childcare infrastructures, mobility restrictions, and cultural norms around women in business. A program in Sweden will look fundamentally different from one in Saudi Arabia, yet both must be equally rigorous.

- Facilitate Business Continuity & Scaling: Mentorship must be paired with operational support—access to affordable accounting services, legal counsel, and supply chain management. Scaling isn’t just about mindset; it’s about building operational resilience to withstand personal and market shocks.

- Support Women in High-Potential Sectors: Beyond STEM education, this requires creating visible role models in tech and AI, de-biasing accelerator selection committees, and funding proof-of-concept grants specifically for women in these fields to derisk their ventures for later-stage investors.

- Integrate Psychological Well-being: Entrepreneurship is isolating. For women facing additional societal pressures, support must include peer networks, access to mental health professionals familiar with founder stress, and training in resilience frameworks that normalize struggle rather than stigmatize it.

- Promote Digital & AI Adoption: Programs must move beyond basic digital literacy to applied integration: “How can a female-owned retail business use AI for inventory forecasting?” or “How can a consultancy use ChatGPT to draft proposals 50% faster?” The focus should be on competitive advantage, not just compliance.

- Broaden Investment Networks: This is the most critical lever. We must:

– Create and fund side-car funds that match new women angel investors with experienced ones.

– Mandate transparency in VC funding data to highlight gender disparities.

– Develop “blended capital” stacks that combine grants, debt, and equity to meet women-led businesses where they are, as they are often reluctant to cede control for growth capital.

As GEM Executive Director Aileen Ionescu-Somers asserts, we must move beyond one-size-fits-all approaches. The goal is not simply to create more women entrepreneurs, but to build inclusive ecosystems where women have an equitable shot at building sustainable, scalable, and impactful businesses. This requires policymakers, investors, and corporate leaders to move from awareness to action—designing interventions that are as nuanced, resilient, and innovative as the entrepreneurs they aim to serve.

Recommendations

This analysis is based on the comprehensive GEM 2024/2025 Women’s Entrepreneurship Report. Full credit for the foundational research and data goes to the Global Entrepreneurship Monitor consortium. We encourage readers to explore the original report for complete datasets and methodological details.