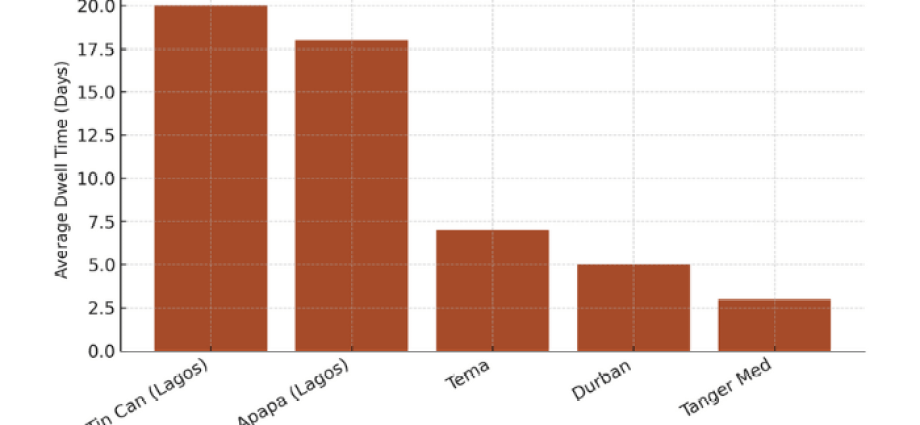

Nigerian SMEs at a Crossroads: Can They Seize the AfCFTA Opportunity or Will They Be Left Behind? Imagine standing at the edge of the largest free trade area in the world—a market worth $3.4 trillion, spanning 54 African nations and 1.4 billion people. For Nigeria’s micro, small, and medium-sized enterprises (MSMEs), this isn’t a distant dream; it’s the reality of the African Continental Free Trade Area (AfCFTA). Yet, as the gates to continental trade swing open, a pressing question looms: Are Nigerian SMEs ready to compete, or will they watch from the sidelines as regional rivals surge ahead? The Stakes: Nigeria’s MSMEs in the Continental Arena Nigeria’s MSMEs form the backbone of the national economy, accounting for a staggering 96% of all businesses and employing 84% of the workforce. These enterprises are not just economic actors—they are the lifeblood of communities, the engines of innovation, and the custodians of Nigeria’s entrepreneurial spirit. But in the era of AfCFTA, spirit alone won’t suffice. The agreement promises access to an unprecedented market, but that access must be earned through efficiency, competitiveness, and strategic foresight. Ghana and Kenya, for instance, are already positioning themselves as continental leaders. They are streamlining logistics, embracing digital finance, and crafting policies that empower small businesses. Nigeria, by contrast, grapples with a trifecta of challenges: weak infrastructure, limited access to finance, and unpredictable regulatory shifts. The nation’s SMEs are caught in a tug-of-war between immense potential and systemic constraints. As Bashir Adeniyi of the Centre for International Trade and Investment (BACITI) notes, global supply chain disruptions and port inefficiencies threaten Africa’s competitiveness. In Nigeria, where over 80% of trade flows through its ports, delays averaging 18–20 days continue to undermine export readiness. The message is clear: Strengthening logistics, digitalization, and trade infrastructure isn’t optional—it’s essential for survival. Benchmarking Competitiveness: How Nigeria Measures Up To understand Nigeria’s position in the AfCFTA landscape, one must look beyond rhetoric and examine hard data. BusinessDay’s SME Competitiveness Scorecard offers a revealing snapshot, evaluating performance across five critical indicators: productivity, logistics, access to finance, digital adoption, and the regulatory environment. Productivity and Output On productivity, Nigerian SMEs lag significantly. Output per worker is nearly 30% below Ghana’s and 40% below Kenya’s. This gap isn’t just a number—it reflects deeper issues like inconsistent power supply, outdated machinery, and underinvestment in human capital. While Kenyan and Ghanaian SMEs benefit from relatively stable infrastructure, their Nigerian counterparts often operate in the shadow of frequent blackouts and logistical bottlenecks. Logistics and Trade Facilitation Logistics remains one of Nigeria’s most significant hurdles. Ghana’s Tema Port, modernized and efficient, ranks among West Africa’s best. In contrast, Nigerian exporters face an average of 20 days of delays at Apapa Port, inflating costs and eroding competitiveness. The World Bank’s 2023 Container Port Performance Index placed Lagos ports 311th out of 370 globally—a stark reminder of the work that lies ahead. Access to Finance When it comes to financing, the disparity is even more pronounced. Only 6% of Nigerian SMEs report access to formal credit, compared to 18% in Kenya, where fintech lending has revolutionized capital flows. High interest rates, stringent collateral requirements, and weak credit profiling exclude the vast majority of Nigerian small businesses from the funds they need to scale and expand regionally. Digital Adoption and Regulatory Hurdles Kenya also leads in digital adoption, driven by the widespread use of mobile money and e-commerce platforms. Nigeria shows strong potential with rising internet usage, but uneven broadband coverage and low digital literacy hinder progress. Add to that regulatory challenges—opaque tax regimes, land titling issues, and policy unpredictability—and it’s easy to see why many SMEs struggle to stay agile. Barriers and Blind Spots: The Roadblocks to Nigerian SME Success What exactly is holding Nigerian SMEs back? The answer lies in a combination of structural barriers and systemic blind spots. Infrastructure and Logistics: Congested ports, dilapidated roads, and high transport costs are more than inconveniences—they are profit killers. Clearing goods through Apapa or Tin Can Island can take up to three weeks, compared to less than a week at Tema Port. In 2023, Lagos ports handled about 1.5 million TEUs, accounting for 70% of Nigeria’s container trade. Yet, efficiency remains a distant goal. Access to Finance: Less than 5% of Nigerian SMEs have access to formal credit. Without capital, businesses cannot invest in technology, expand operations, or explore new markets. High interest rates and collateral demands lock out many promising ventures, stifling innovation and growth. Policy Inconsistency: Frequent regulatory shifts and currency volatility make long-term planning a gamble. SMEs operate in an environment where today’s opportunity can become tomorrow’s liability, discouraging investment and fostering a culture of caution over ambition. Skills and Technology Readiness: Only about 30% of Nigerian SMEs are digitally equipped, compared to nearly 60% in Kenya. This gap limits participation in e-commerce, digital payments, and cross-border platforms—all critical enablers of AfCFTA trade. Emerging Strengths: Reasons for Optimism Despite these challenges, Nigeria is not without its advantages. The nation’s 220-million-strong consumer base is the largest in Africa, offering SMEs a domestic testing ground before venturing into regional markets. This scale provides a unique springboard that many African peers lack. Sectorally, there are bright spots. Agro-processing clusters in states like Ogun and Kaduna are turning raw agricultural output into value-added exports. The creative economy—spanning film, fashion, and beauty—is positioning Nigerian SMEs as cultural exporters with continental appeal. Perhaps most promising is Nigeria’s fintech ecosystem. From digital payments to trade financing, homegrown platforms are bridging gaps in SME credit and enabling cross-border e-commerce. While Kenya may have a head start, Nigeria’s fintech innovators are rapidly closing the gap. By 2027, Nigeria could emerge as AfCFTA’s consumer hub, leveraging its scale and technological infrastructure. But without addressing infrastructure and regulatory blind spots, it risks becoming a market for others rather than a leading supplier. Investor and Market Implications: Where Opportunity Meets Caution For investors, AfCFTA represents both a monumental opportunity and a complex risk landscape. Nigeria’s scale is undeniable, but the smart money will flow to sectors with resilience and growth potential: agro-processing, fintech, and light manufacturing. Agro-processing, particularly in cassava, cocoa, and palm derivatives, offers the chance to move up the value chain from raw commodities to export-ready products. Fintech remains the backbone of SME trade enablement, with digital payments, credit scoring, and cross-border settlement emerging as high-growth areas. Light manufacturing—textiles, packaging, and consumer goods—also holds strong regional demand, provided production costs can be managed. Yet, risks abound. Foreign exchange volatility remains a profitability killer, while policy reversals and regulatory opacity have derailed promising ventures in the past. Navigating Nigeria requires deep local knowledge, active risk management, and a long-term perspective. For bold investors, underserved export niches—such as processed foods, fashion, and digital services—offer asymmetric upside. The key is to avoid overexposure to import-dependent models and anchor strategies in Nigeria’s domestic demand base. Conclusion: The Path Forward Nigeria stands at a pivotal moment. The AfCFTA offers a once-in-a-generation opportunity to reshape its economic destiny, but success is not guaranteed. The nation’s SMEs—representing 96% of businesses and 84% of employment—are on the front lines of this transformation. To compete and thrive, Nigeria must address its infrastructure deficits, expand access to finance, and foster a stable regulatory environment. It must invest in digital literacy and leverage its fintech ecosystem to bridge competitiveness gaps. Most importantly, it must empower its SMEs with the tools, policies, and confidence to scale beyond borders. The race for AfCFTA relevance is already underway. Ghana and Kenya are sprinting ahead, but Nigeria has the scale, the talent, and the tenacity to catch up. The question is not whether Nigerian SMEs can compete—it’s whether they will be given the chance to do so. In the words of an industry insider, “AfCFTA is not a participation trophy. It’s a competitive arena. Nigeria must enter not just as a player, but as a contender.” The world is watching. Will Nigeria rise to the occasion?

2025-10-10