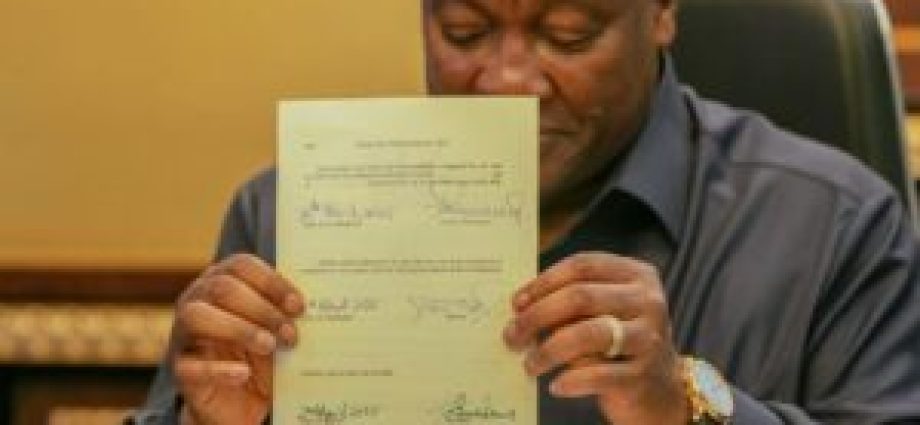

E-Levy Finally Scrapped in Ghana – President Mahama Signs Repeal Bill

End of Controversial Digital Tax

The long-awaited removal of Ghana’s Electronic Transfer Levy (E-Levy) has finally become reality following the change of government after the December 2024 elections. On March 2, 2025, President John Mahama officially signed the Electronic Transfer Levy (Repeal) Bill 2025 into law, abolishing the contentious tax that many Ghanaians viewed as regressive.

Background of the E-Levy

Originally introduced in 2022, the E-Levy faced significant public opposition from its inception. Despite widespread criticism from citizens and financial stakeholders who argued it would:

- Increase financial burdens on ordinary Ghanaians

- Undermine financial inclusion progress

- Hinder digital payment adoption

the previous administration maintained its implementation.

How the Repeal Process Unfolded

The repeal process gained momentum when Ghana’s Parliament approved the Electronic Transfer Levy Repeal Bill 2025 in March 2025. This legislative action effectively ended the digital tax that had been applied to:

- Mobile Money transactions

- Bank transfers

- Inward remittances

Tax Rate Evolution

The E-Levy initially imposed a 1.75% charge on transactions before being reduced to 1% following public pressure. Many Ghanaians had labeled it as “the most senseless tax,” making its removal a significant victory for consumer advocates and ordinary citizens alike.

Public Reaction and Impact

The abolition of the E-Levy has been met with widespread approval across Ghana, with citizens celebrating the return of more disposable income. Financial analysts predict this move will:

- Boost digital transaction volumes

- Increase financial inclusion

- Stimulate economic activity

By Emmanuel K Dogbevi