The Hidden Costs of Sending Money Home: A Look into Malawi’s Remittance Rates

- Malawi bets on diaspora for economic recovery with Diaspora Cities initiative

- High bank fees deter diaspora remittances, negatively impacting the economy

- Potential solutions include fee caps, increased competition, and mobile money adoption

Malawi’s government has placed a strategic bet on its diaspora community to jumpstart economic recovery through the newly announced “Diaspora Cities” program. Spearheaded by Finance Minister Simplex Banda, this initiative aims to attract foreign currency estimated at K250 million annually by offering Malawians abroad streamlined property purchase options in designated urban areas.

Malawi Diaspora Cities: A Vision for Economic Growth

The ambitious program promises diaspora members plots in four major cities with enhanced social services including schools, clinics, and recreational facilities. However, concerns remain about whether this addresses the fundamental challenges facing remittance flows to Malawi.

Declining Remittances: A Troubling Trend

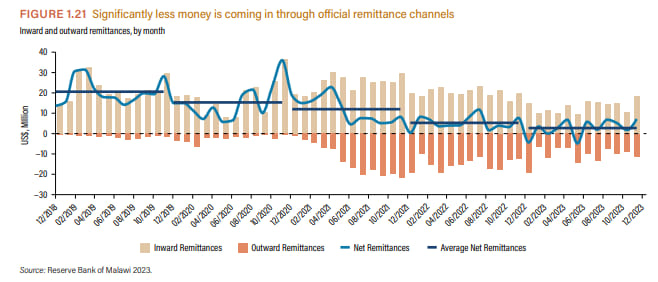

Recent data from the Reserve Bank of Malawi reveals concerning trends:

- Decreasing inward remittances from Malawians abroad

- Increasing outward remittances from Malawi

- Negative net flows in some months

The High Cost of Sending Money Home

Malawian social media influencer Onjezani Kenani, based in Europe, highlights the core issue:

“Commercial banks are busy courting the diaspora, but they do so with words. The reality is that the official rates remain unrealistic and discourage remittances through formal channels… There is a need to move on from mere sloganeering about diaspora remittances to tangible action on rates.”

Key pain points include:

- Exorbitant bank fees on remittances

- Unfavorable exchange rates at ATMs for foreign cards

- Lack of transparency in fee structures

Solutions to Boost Diaspora Remittances

Experts suggest several approaches to address these challenges:

1. Regulatory Intervention

The Reserve Bank could implement fee caps to ensure fair and transparent remittance pricing.

2. Promoting Competition

Encouraging more money transfer providers could drive down costs through market competition.

3. Mobile Money Innovation

Expanding affordable mobile money transfer options could provide diaspora members with lower-cost alternatives.

Diaspora Banking Options

Many Malawian banks offer specialized diaspora accounts with benefits including:

- Higher interest rates on savings

- Free internet banking services

- Investment opportunities in real estate and other sectors

Important Note: Some banks impose severe penalties (up to 40% of earned interest) for early withdrawals without proper notice. Diaspora members should carefully review terms before opening accounts.