“`html

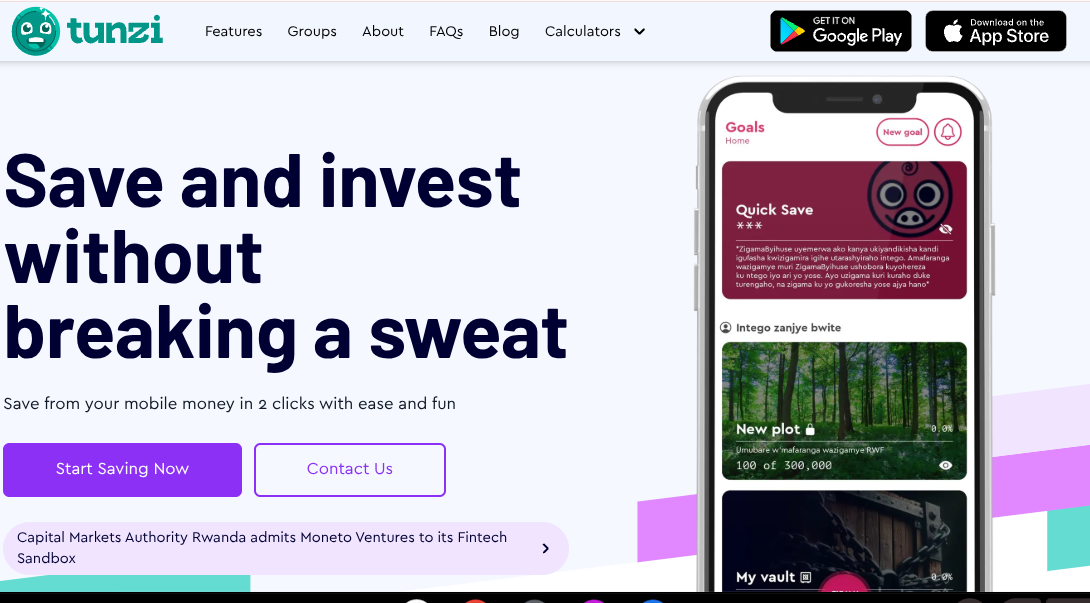

Rwanda’s Digital Savings Revolution: Tunzi App Launches to Transform Financial Habits

A groundbreaking mobile savings application is set to revolutionize Rwanda’s financial landscape, offering seamless technology-driven solutions that encourage consistent saving habits based on users’ spending patterns.

Addressing Rwanda’s Savings Gap

Recent data from the FinScope Survey 2024 reveals that while formal savings in Rwanda increased from 54% in 2020 to 59% in 2024, significant challenges remain:

- 23% of Rwandans still rely on informal savings mechanisms

- 3% keep their savings at home

- 15% of the population doesn’t save at all

How Tunzi Works

The Tunzi application, developed by Moneto Ventures, leverages advanced analytics to make saving effortless:

- Automatically saves when users send/receive money or make purchases

- Provides real-time progress tracking

- Integrates with everyday financial transactions

“Our platform’s technology-driven approach removes the friction between the decision to save and the actual action. Tunzi makes the process simple and automated,” said Samuel Njuguna, CEO of Moneto Ventures Limited.

Regulatory Backing and Financial Security

The application is part of the Rwanda Capital Market Authority’s Fintech Regulatory Sandbox program, launched in 2023. In partnership with BK Capital, a licensed fund manager, Tunzi ensures:

- Secure handling of user funds

- Compliance with financial regulations

- Integration with investment opportunities

Impact on Rwanda’s Financial Ecosystem

Siongo Kisoso, Managing Director of BK Capital, highlighted the app’s potential:

“Platforms like Tunzi are revolutionizing how people save. We’ve witnessed firsthand how it’s driving a shift in financial behavior through technological innovation.”

Key Features and Benefits

- Low minimum savings: Start with just Rwf50

- Flexible top-ups: Add any amount at any time

- Daily interest accrual: Funds are invested to earn returns

- Accessible platform fee: 2.5% of distributed interest

Availability and Competition

The Tunzi app is now available on both the Apple App Store and Google Play Store, entering a market that includes similar solutions like Exuus Ltd’s SAVE App, which builds on traditional savings group models.

As Rwanda continues its digital transformation journey, fintech innovations like Tunzi are playing a crucial role in:

- Bridging the savings gap

- Promoting financial inclusion

- Building economic resilience

- Empowering individuals with sustainable financial habits

This article is based on original reporting by KT PRESS. For complete details, please visit the original source.

“`