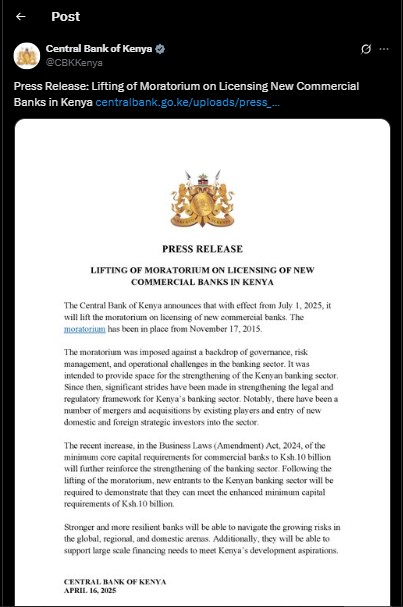

CBK Lifts 9-Year Ban on Licensing New Commercial Banks

The Central Bank of Kenya (CBK) has officially lifted its decade-long moratorium on licensing new commercial banks, marking a significant shift in Kenya’s banking sector policy.

End of Banking Restrictions

In an April 16, 2025 statement, CBK announced the embargo removal will take effect July 1, 2025, ending restrictions in place since November 17, 2015. This decision opens Kenya’s financial sector to new domestic and international banking institutions.

“The Central Bank of Kenya announces that, with effect from July 1, 2025, it will lift the moratorium on licensing of new commercial banks.”

CBK Official Statement

Why the Moratorium Was Implemented

The original restriction was implemented to address critical challenges in Kenya’s banking sector, including:

- Governance issues

- Risk management deficiencies

- Operational challenges

Sector Strengthening Achievements

During the moratorium period, CBK reports significant improvements in Kenya’s banking landscape:

- Enhanced legal and regulatory framework

- Multiple mergers and acquisitions

- Entry of new strategic investors

- Increased minimum capital requirements to Ksh10 billion

New Licensing Requirements

Prospective banks must now meet stringent criteria including:

- Demonstrated ability to meet Ksh10 billion capital requirement

- Proven capacity to manage growing financial risks

- Commitment to supporting Kenya’s development financing needs

CBK Governor Kamau Thugge emphasized that these measures will ensure “stronger and more resilient banks” capable of supporting Kenya’s economic growth.

Original reporting by People Daily Digital