South Sudan Revenue Authority Warns Importers Over Rising Costs at Kenyan Ports

Importers Face Potential Losses as Goods Face Auction in Kenya

JUBA – The South Sudan Revenue Authority (SSRA) has issued a stern warning to importers, urging them to properly calculate all expenses including transportation costs from Kenya to avoid significant financial losses.

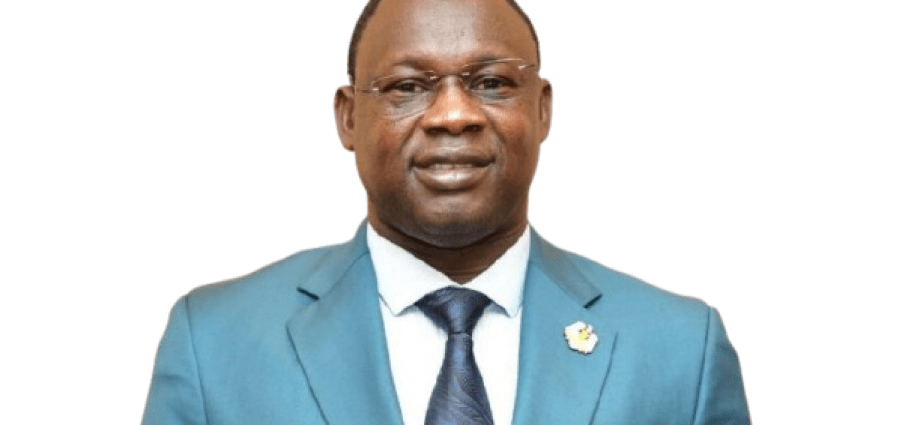

Deputy Commissioner General Taban Abel made these remarks following media reports that goods worth millions of Kenya shillings destined for South Sudan – including United Nations shipments – face auction at Kenya’s Inland Container Depot (ICD) in Nairobi.

Impending Auction Details

According to Kenyan media, the affected goods include:

- Critical construction materials

- Electrical components

- Food items

- Other essential consumer goods

The auction notice, issued on March 17 under Section 42 of the East African Community Customs Management Act 2004, states that unclaimed goods will be sold at public auction between May 5-9, 2025.

Why Goods Are Being Auctioned

Commissioner Taban explained that the issue stems from importers failing to account for all costs in their supply chain:

“When you bring your cargo, you put it there and you are paying daily for it. So, if you exceed the number of days that you are supposed to take it to the country of destination, then the amount will keep mounting more than you can afford.”

He provided a concrete example: “The storage per day in Mombasa in internal cargo depots is $250 USD. If you have a container worth $3,000 USD that you haven’t cleared, the storage fees can quickly exceed the value of the goods.”

Key Recommendations for Importers

The SSRA advises importers to:

- Calculate all transportation costs upfront

- Factor in storage fees at transit points

- Plan for timely clearance of goods

- Account for all costs from origin to final destination

Taban emphasized, “Our people have to be aware that you have to calculate the cost of bringing your items all the way up to the final destination instead of wasting your money.”

Impact of E-Taxation System

The official noted that South Sudan’s new e-taxation system has made it harder for importers to smuggle goods into the country, increasing the risk of goods being auctioned in Kenya when importers can’t complete proper clearance procedures.